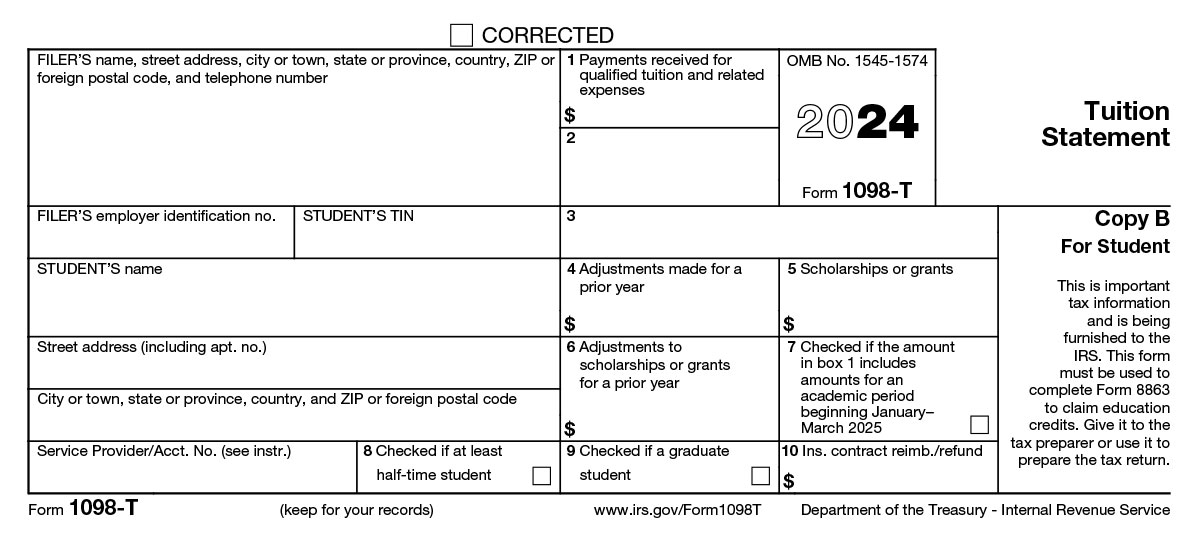

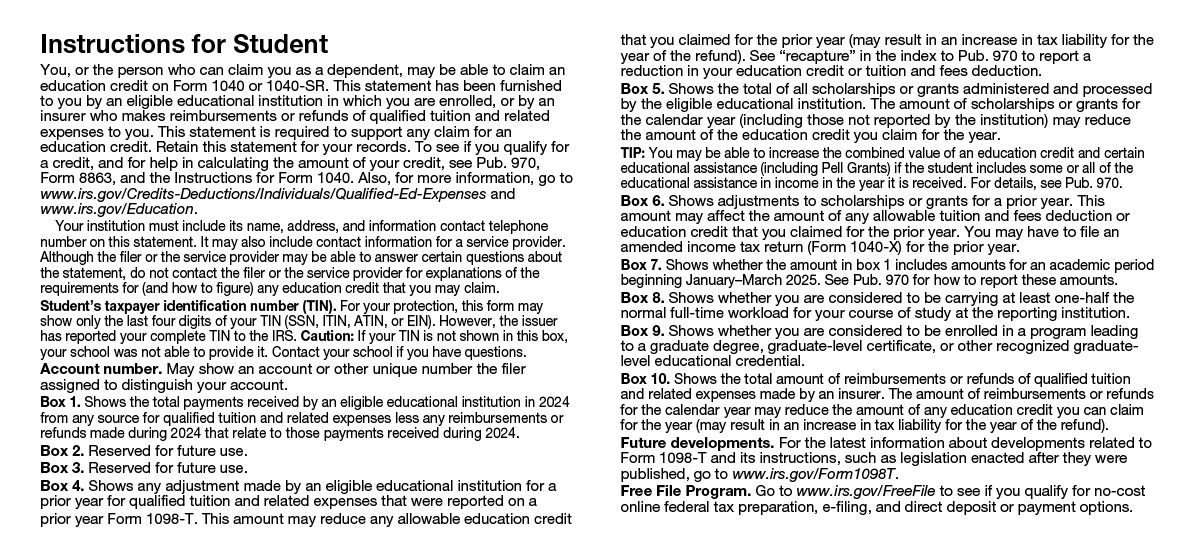

1098-T Tax Information

Oakland Community College provides 1098-T tax statements to the Internal Revenue Service

(IRS) on behalf of its students. Oakland Community College is unable to provide you

with individual tax advice, but should you have questions, you should seek the counsel

of an informed tax preparer or advisor.

For more information about Form 1098-T, visit IRS Education Credits.

If you have questions regarding accessing your 1098-T statement that are not addressed below, contact AR@oaklandcc.edu or call the OCC 1098-T Hotline at (248) 341-2262.